Why Your Trading Needs Speed, Not Just Strategy: Multi-Broker Execution Case

Blog by Cirrus.Trade

Strategy Alone Won’t Win Trades Anymore

Traders in India spend years perfecting strategies. They study candlestick patterns, backtest indicators, and follow expert advice. Yet when markets open, reality is different. Execution speed decides the outcome, not just the strategy.

In May 2025, GIFT Nifty reached a record monthly derivatives turnover of $102.35 billion (~₹8.75 lakh crore)” (Livemint). In such high volumes, even a two-second delay changes results. For options traders, where premiums move in milliseconds, speed is survival. The fastest trading platforms in India often make the difference between profit and loss.

Article that Might Interest you: Best Option Trading Platform for Beginners in India. Read

The Changing Landscape of Options & Derivatives Trading

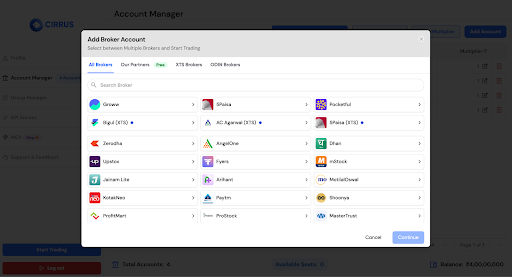

Trading today is not limited to one broker’s terminal. Retail traders now manage multiple accounts. They do this to diversify risk or use brokerage offers.

But this shift creates new problems. How do you place the same trade across multiple accounts without delays? Tools like a multi-broker trading app or multi-broker execution tools in India are solving this gap. They let traders execute one trade in multiple accounts instantly, without tab switching.

Why Milliseconds Matter in Order Execution

Imagine placing a buy order on one broker’s app, then rushing to two more. By then, the price has moved. This latency in order execution costs money. It slowly eats into your edge.

For active scalpers, does order execution speed affect profits? Yes, every day. This is why traders increasingly look at broker API speed comparison in India before choosing tools. A platform with low-latency order execution in India gives a lasting edge.

Article Suggestion to Read: Multiply Your Trades, Not Your Effort – Smart Multipliers on Cirrus

How Latency and Slippage Destroy Profits

Slippage occurs when orders execute at worse prices than intended. Even the best strategy loses money here. A CFA Institute study showed high slippage can reduce profitability by up to 30%.

The solution? Tools that help avoid slippage in options trading. The best setups provide trade execution without lag in India. Some also include a real-time scalping execution tool that places SL and TP across all accounts instantly.

Understanding Multi-Broker Execution

What is multi-broker execution?

Multi-broker execution allows traders to place a single order. That order replicates instantly across all connected accounts. No juggling tabs. No missed opportunities.

Benefits for active and options traders

- Consistency: Same trades across family or client accounts.

- Time-saving: One click execution across accounts saves critical seconds.

- Reduced mismatch risk: Stop-loss (SL) and take-profit (TP) stay aligned.

Why serious traders need execution consistency

For serious traders, execution consistency is non-negotiable. Whether managing personal accounts or family funds, multi-broker execution ensures strategies run smoothly.

Interesting Article - The Multi-Demat Account Mess Nobody Talks About

The Real Challenge - Fast Trade Execution in India

How slippage occurs in volatile markets

When markets move quickly, the price you see isn’t always the price you get. Slippage increases during events like RBI announcements, earnings seasons, or sudden spikes in NIFTY and BANKNIFTY options. For traders trying to capture short bursts of movement, this delay is costly.

Latency in order execution: causes & trader impact

- Manual tab switching: Wastes precious seconds.

- App/server delays: Broker platforms face high loads during peak hours.

- Network instability: Even a 1–2 second lag can throw off trade timing.

For intraday traders, even one second hurts. A ₹2,000 profit can turn flat, or worse, into a loss.

To solve this, traders seek fast trade execution in India tools. The best ones allow multi-account execution vs copy trading with one-tap consistency.

Why one-tap execution across brokers is becoming critical

To avoid this, traders are looking for fast trade execution India solutions that allow one-tap order copy across accounts. This ensures not only speed but also the confidence that no account has been left out of the setup.

Multi Broker Tools vs Copy Trading Apps - What’s the Difference

Is Copy Trading Legal in India?

Copy trading is popular worldwide. It lets you mirror another trader’s orders. But in India, SEBI has raised concerns. Many copy trading apps work in grey zones. So, is copy trading legal in India? The short answer: not fully. Traders should be cautious.

Risks of Relying on Copy Trading

- Lack of control: You inherit someone else’s decision-making, even if it doesn’t suit your risk profile.

- Regulatory uncertainty: SEBI rules don’t currently allow unregistered advisors or apps to provide automated investment advice.

- Blind reliance: You may end up copying a trade that doesn’t match your capital or strategy.

Why execution tools are built for control, not blind copying

Execution tools give you control. They don’t decide trades for you. Instead, they let you execute one trade in multiple accounts instantly. This is the core difference between copy trading vs execution tools.

For active traders, this matters. With execution tools, you decide the plan, and the tool ensures low-latency in order execution India. No reliance on outsiders. No compliance risk.

What Traders Actually Look For in an Execution Stack

One-tap order copy across accounts

The most valuable feature for active traders is one-tap trading across brokers. It eliminates the stress of repeating the same order multiple times and reduces error rates.

Real-time SL/TP trades to minimize exposure

When placing stop-loss and take-profit orders, speed is non-negotiable. Execution tools that ensure real-time SL TP trades across all accounts give traders the confidence that risk is managed consistently.

Reliability under high-volume orders

During events like Budget Day or FED announcements, brokers can experience lags. An execution stack that continues to deliver fast trading execution tool India-style performance under pressure is what separates serious tools from basic apps. Reliability is the mark of the fastest trading execution platforms in India.

TradingView signals to trades: bridging strategy with execution

Many traders design strategies on TradingView. But if those signals take time to turn into live trades, opportunities vanish. Tools that connect TradingView signals to trade execution in real time are filling this gap.

Another Interesting Article - Simplify Your Trading Journey with Cirrus

Cirrus in Context - How It Stands Against Alternatives

Is Cirrus better than Zerodha Kite for multi-broker execution?

Zerodha Kite is a strong broker terminal, but it is limited to one account at a time. For traders managing multiple accounts, that creates a bottleneck. Cirrus offers multi-broker execution tools in India, which means one action can be replicated across several broker accounts at

Comparing Cirrus with Copy Trading Apps

Unlike grey-zone copy apps, Cirrus doesn’t make decisions for you. It focuses only on execution. Traders searching for a Cirrus multi-broker trading review often highlight one thing: faster execution and less impact of latency in stock trading.

Why Cirrus Focuses on Speed and Control

Cirrus is built as an execution stack. It reduces slippage in options trading, cuts latency, and improves reliability. For traders, it answers the big question: difference between algo trading and manual execution speed. The answer is clear, speed wins.

The Bottom Line for Options Traders

Why Speed + Execution Stack > Strategy Alone

Even the sharpest strategy fails with poor execution. A reliable, fast trading execution tool in India ensures your plan converts into actual results.

How Multi Broker Execution Future-Proofs Your Trading

With Indian retail trading volumes growing rapidly. Traders using multi-broker trading apps today are ready for the next wave. Adopting a multi-broker execution approach is better equipped to handle the volatility. It’s not about trading more, but trading smarter and faster.

Practical next steps to evaluate an execution tool

- Test execution speed during market hours.

- Check SL and TP across all accounts in real time.

- Compare latency with manual order punching.

- See if it offers the fastest way to punch orders in multiple accounts.

Conclusion

In trading, strategy sets the direction, but execution speed decides your P&L. Without addressing multi-broker execution, traders risk losing their advantage to latency and slippage. Tools designed for one-tap order copy and fast trade execution in India offer a clear edge for serious options traders.

If you’re evaluating tools, consider this: Does your current setup allow you to execute the same trade across brokers instantly?If not, it may be time to explore alternatives built for reliability.

Platforms like Cirrus deliver:

- Fast trade execution in India

- One click execution across accounts

- Real-time scalping execution tools

If you’re still asking, how fast do brokers execute orders in India? — now is the time to test.

Start with Cirrus today. Experience trade execution without lag India and see the difference in your results.

Editor's Choice Article:

Trade Smarter: How Cirrus Lets You Execute Across Multiple Brokers Without Switching Tabs. Read

Why Algo Traders Are Moving to Cirrus for Multi-Account Execution. Read

How Groww Users Can Now Unlock Algo Trading with Cirrus: Step-by-Step Guide