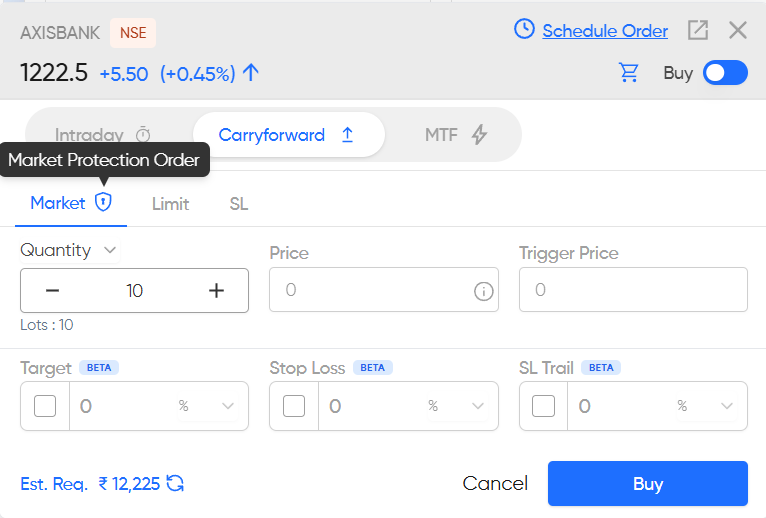

Why Cirrus has Enabled Market protection on the order window !

What is Market Protection Order ?

Market protection executes your orders immediately at the best available price while reducing the risk of price variation. Unlike a regular market order that can be filled at any price, market protection converts your market order into a limit order if the price moves outside a set protection range. This helps you avoid execution at a price that differs greatly from your intended price, offering protection against extreme price fluctuations.

If the market moves outside your protection range, you risk that not all of your shares will be executed. The remaining quantity will remain open as a limit order.

How market protection works

The protection range is calculated based on the current market price when you place your order. For instance, the protection might be set to a certain percentage above the current bid (for your buy order) or below the current ask (for your sell order). If your order cannot be filled immediately within the protection range, it will be converted to a limit order at the calculated protection price.

Market protection percentage is calculated based on the security type and price range:

| Security Type | Price Range (in ₹) | Percentage of Last Traded Price (LTP) |

|---|---|---|

| EQ (Equity) and FUT (Futures) | Less than 100 | 2% |

| EQ (Equity) and FUT (Futures) | Between 100 and 500 | 1% |

| EQ (Equity) and FUT (Futures) | More than 500 | 0.5% |

| OPT (Options) | Less than 10 | 5% |

| OPT (Options) | Between 10 and 100 | 3% |

| OPT (Options) | Between 100 and 500 | 2% |

| OPT (Options) | More than 500 | 1% |

Example scenario

Consider that a stock is currently trading at ₹90.

- Your buy order: You place a market price protection buy order for 100 shares.

- Protection range: A protection range of 2% above the current price is established since the price is less than ₹100. As a result, your protection limit price is set at ₹91.80.

- Order execution: Your order attempts to execute immediately, buying shares at ₹91.80 or below, ensuring you get the best available price within that limit.

- Limit order placement: If your order cannot be filled for 100 shares within this range, the remaining quantity will remain open as a limit order at ₹91.80.

Reference Sources : https://support.zerodha.com/category/trading-and-markets/charts-and-orders/order/articles/market-price-protection-on-the-order-window

Why Cirrus has Enabled it :

SEBI has mandate for any Algorithm the trades should be Place Via Market Order Protection and not as Market Price for safeguard of Users.