How SEBI-Registered Research Analysts Can Automate Compliance in 2025

SEBI RA compliance automation is a structured workflow that automates MITC acceptance, digital KYC, SEBI-aligned reporting, and audit-ready records so Research Analysts can scale without manual admin. Cirrus RA Marketplace is built to scale SEBI RA advisory businesses in India.

India’s advisory ecosystem has matured rapidly over the last few years. As investor participation increases, so do expectations around transparency, documentation, and regulatory discipline. For SEBI-registered Research Analysts (RAs), compliance is no longer a background requirement, it has become a daily operational reality.

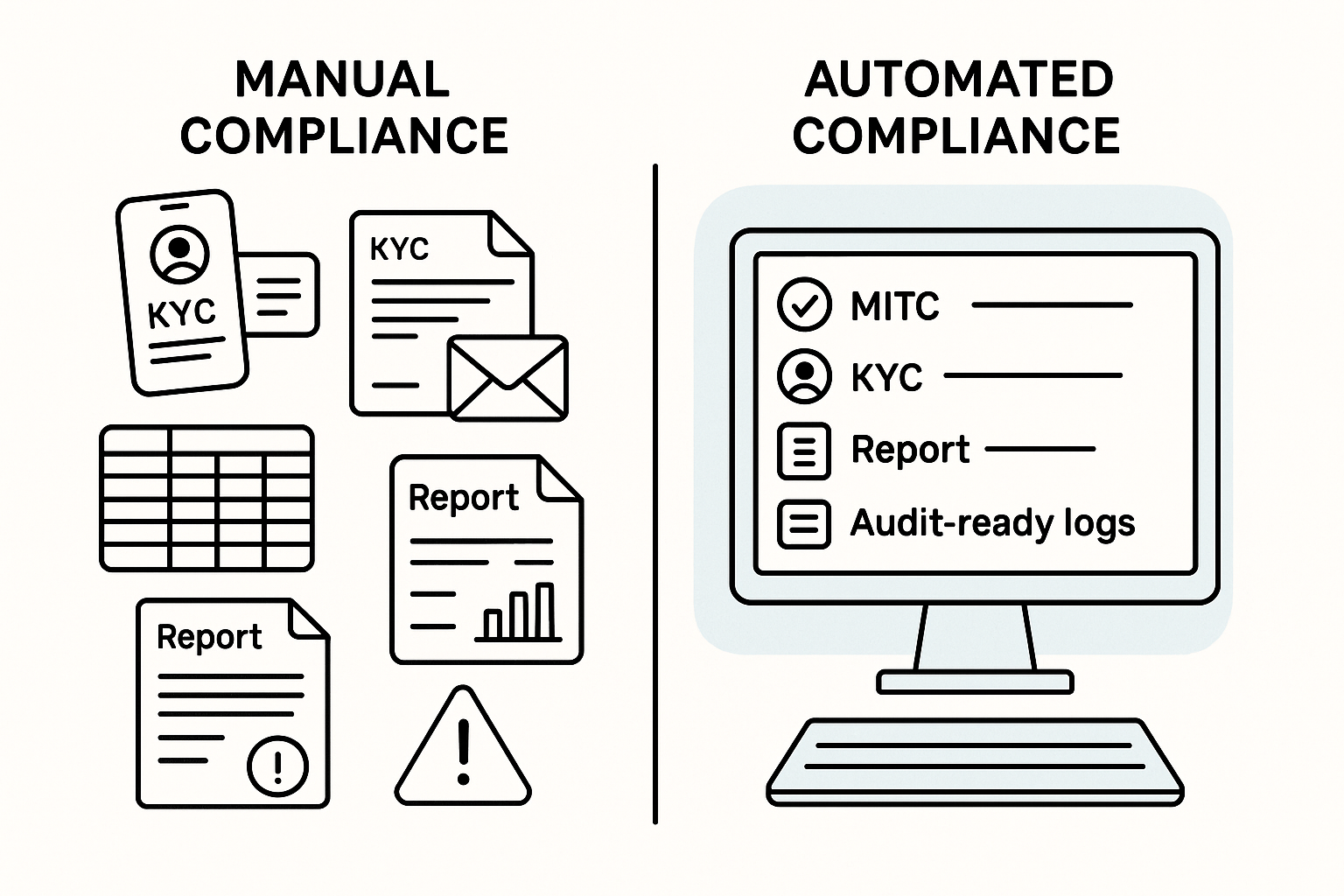

MITC agreements, client KYC, periodic reporting, performance records, audit trails, each of these is mandatory. Yet most Research Analysts still manage them manually. This creates friction, errors, and most importantly, a ceiling on growth.

In 2025, RA compliance automation is no longer optional. It is the foundation on which scalable, professional advisory businesses are built.

This article explains what SEBI compliance really involves for RAs, why manual systems break down, and how automation helps Research Analysts operate with confidence and scale.

The Compliance Reality for SEBI Research Analysts

SEBI’s regulatory framework for Research Analysts is designed to protect investors and ensure advisory integrity. The intent is clear but execution often becomes burdensome.

Most RAs are required to manage:

- MITC (Most Important Terms & Conditions) documentation for every client

- KYC collection and verification

- SEBI-formatted reporting

- Performance disclosures and audit readiness

- Client access control and records

On paper, these look manageable. In practice, they consume hours every week.

Manual workflows increase the risk of:

- Incomplete documentation

- Inconsistent formats

- Delayed reporting

- Audit exposure

- Operational fatigue

This is where SEBI RA compliance automation becomes critical,not by-passing the regulation, but to implement it correctly and consistently.

Why Manual Compliance Breaks Down at Scale

Most Research Analysts start small. With 10 or 20 clients, manual processes appear workable. But as advisory businesses grow, compliance complexity grows exponentially.

1. MITC Becomes Unmanageable

Every new client requires proper MITC acknowledgement. Tracking versions, dates, and signatures manually leads to gaps. Missing or outdated MITC records are among the most common compliance risks for RAs.

Without MITC automation, scaling advisory services introduces unnecessary exposure.

2. KYC Collection Is Fragmented

KYC documents arrive via email, WhatsApp, Google Drive, or physical copies. Verification becomes inconsistent. Retrieval during audits is time-consuming.

A structured KYC automation for SEBI RAs ensures uniformity, traceability, and secure storage.

3. Reporting Is Time-Consuming and Error-Prone

SEBI reporting requires structured formats and consistent data points. Many RAs rely on spreadsheets and manual compilation.

As subscriber counts increase, reporting becomes a bottleneck. SEBI reporting automation removes this friction by standardising outputs.

4. Audit Readiness Is Always Reactive

Most RAs prepare compliance documentation only when required. This reactive approach increases stress and risk.

Automation creates continuous audit readiness, not last-minute fixes.

What Compliance Automation Actually Means for RAs

There’s a misconception that compliance automation is about replacing regulation with software. In reality, it’s about embedding regulatory discipline into daily workflows.

For Research Analysts, RA compliance automation means:

- MITC processes that trigger automatically during onboarding

- Digital KYC workflows that are uniform and verifiable

- Reporting formats that align with SEBI expectations by default

- Performance records that are structured and timestamped

- Documentation that is always audit-ready

Automation does not reduce compliance bur strengthens it.

Key Areas Where SEBI RAs Can Automate Compliance

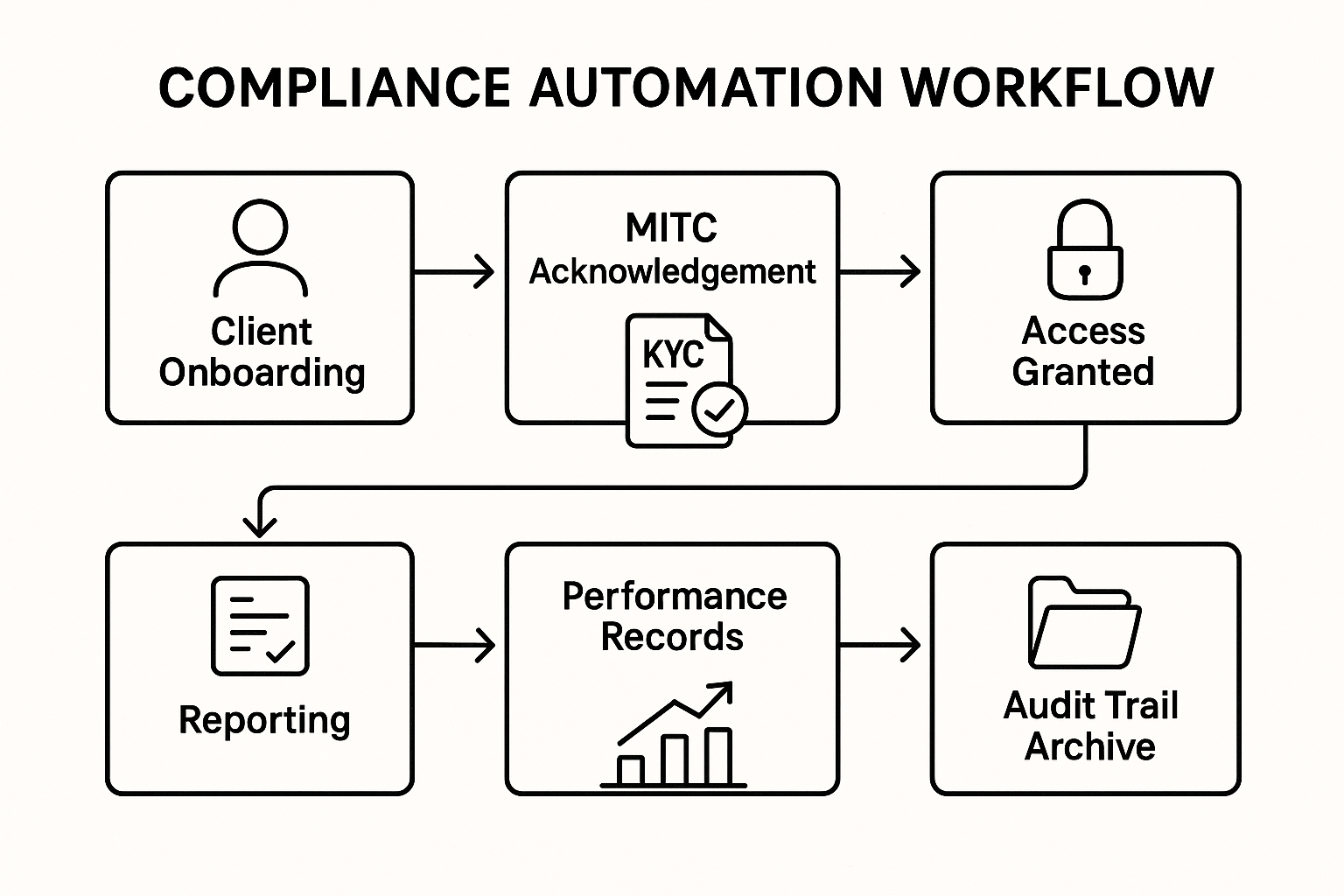

1. MITC Automation for Research Analysts

Automated MITC workflows ensure:

- Correct versions are always used

- Clients acknowledge terms digitally

- Records are stored securely

- Access is granted only after completion

This removes manual follow-ups and eliminates gaps.

Using MITC automation for Research Analysts allows advisory businesses to onboard clients without operational friction.

2. KYC Automation for SEBI RAs

KYC automation standardises:

- Document collection

- Verification workflows

- Storage and retrieval

- Access controls

A single source of truth replaces scattered files and messages. This is essential for any Research Analyst platform in India operating at scale.

3. SEBI Reporting Automation

Automated reporting ensures:

- Consistent formats

- Accurate data aggregation

- Timely generation

- Easy audit access

Instead of rebuilding reports manually, RAs operate with pre-structured outputs aligned with SEBI norms.

This is where SEBI RA compliance automation delivers the highest time savings.

4. Performance Records and Audit Trails

Maintaining performance disclosures manually is risky. Automation allows:

- Timestamped records

- Structured trade data

- Clear attribution

- Long-term storage

This improves transparency and strengthens trust with both regulators and clients.

How Compliance Automation Enables Advisory Scale

Compliance is often seen as a blocker to growth. In reality, it is the enabler when done right.

With automation:

- Onboarding 10 clients or 1,000 clients requires the same effort

- Compliance effort does not increase with subscriber count

- Advisory quality improves because time shifts back to research

- Teams don’t need to expand just to manage documentation

This is why scale advisory business RA conversations always lead back to automation.

A Research Analyst cannot grow sustainably without a system that absorbs operational load.

Why 2025 Is a Turning Point for Research Analysts

Regulatory scrutiny is increasing. Investor awareness is improving. Informal advisory setups are being questioned.

In this environment, tools for Research Analysts must do more than just distribute signals. They must support compliance by design.

Platforms that offer SEBI RA compliance automation, structured onboarding, and reporting will define the next phase of advisory businesses in India.

Those relying on spreadsheets, manual KYC, and ad-hoc documentation will struggle to keep up.

Choosing the Right Compliance-First Infrastructure

Not all tools are built for RAs. When evaluating platforms, Research Analysts should look for:

- End-to-end compliance workflows

- Built-in MITC and KYC automation

- SEBI-aligned reporting formats

- Audit-ready data structures

- Scalability without added operational burden

A true Research Analyst platform India understands regulation first and builds technology around it.

FAQ Pack

- What is SEBI RA compliance automation? It’s a structured workflow that automates MITC acceptance, KYC collection, reporting, and audit-ready recordkeeping for SEBI-registered Research Analysts.

- Why do SEBI RAs need MITC automation? Because manual MITC tracking breaks as subscriber count grows, increasing compliance risk and admin time.

- How does KYC automation help SEBI RAs? It standardises collection, verification, storage, and retrieval, reducing errors and improving audit readiness.

- What is SEBI reporting automation? It means generating consistent, structured reports aligned with required formats without manual spreadsheet work each cycle.

- Can compliance automation help scale an RA advisory business? Yes, because onboarding and reporting effort stays stable even as subscribers increase, enabling scale without hiring ops staff.

Final Thoughts: Compliance as a Competitive Advantage

In 2025, compliance is no longer a cost of doing business. It is a competitive advantage.

Research Analysts who adopt RA compliance automation gain:

- Operational clarity

- Audit confidence

- Scalability

- Professional credibility

Most importantly, they reclaim time, time that can be reinvested in what truly matters: research, analysis, and strategy.

As the advisory ecosystem evolves, one truth is clear:

The future belongs to SEBI Research Analysts who automate compliance early and build their advisory business on strong foundations.

And that is the reason we have launched Cirrus RA Marketplace that not only allow RAs to automate their operations but also gives Cirrus users freedom of choice to opt in for advisory from RAs that is aligned with them.

If you are an RA and want to explore the platform - please book your demo here: Cirrus RA Markeplace.