No-Code Algo Trading: Build & Run Strategies Without Coding

You don’t need to code to automate your trading. This Cirrus guide explains how no-code algo trading works, with rule templates, risk controls, and examples of algo trading without coding — a simple, safe way to scale your strategies across multiple accounts.

Blog by Cirrus.Trade

For most traders, “algo trading” still sounds like something only coders or quants can do. But today, no-code algo trading tools have made automation accessible to anyone who understands strategy - not syntax.

This guide shows you how to build, test, and run strategies without writing a single line of code. We’ll also discuss what parts you shouldn’t automate, and where algo trading without coding fits best in your trading workflow.

Why Manual Traders Struggle to Scale

Manual trading works - until you try to manage multiple accounts, track risk, or follow more than one strategy at once. Missed entries, delayed exits, and inconsistent stop-loss discipline often stem from the execution side, not from the strategy itself.

The challenge isn’t your analysis. It’s the lack of a reliable, repeatable system.

That’s where no-code algo trading changes the game: it lets you translate your existing logic into a structured, automated flow, without needing to write a single script.

Interesting Read: Best Algo Trading Platforms in India (2025 Comparison Guide)

What “No-Code” Really Means in Trading

“No-code” doesn’t mean “zero control.” It means visual configuration instead of programming.

You decide what to trade, when to trigger, and how much to risk - the tool handles the mechanical side.

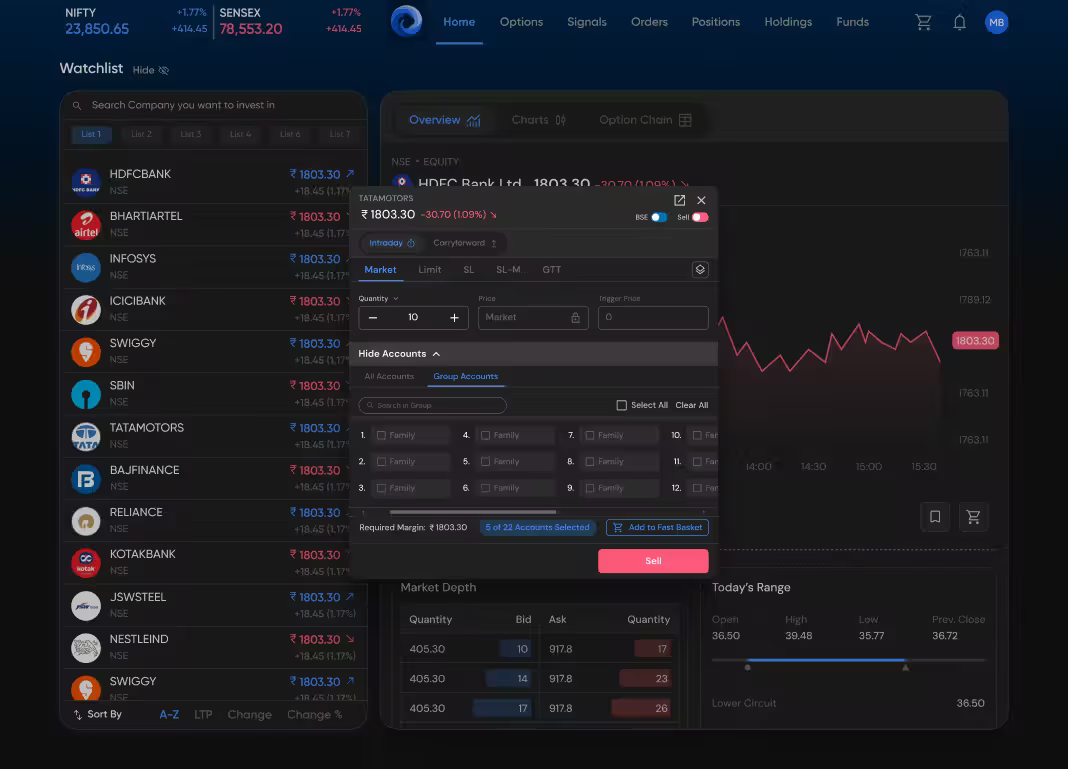

Here’s how it typically works in an algo execution platform like Cirrus:

1️⃣ You design rules in TradingView or another signal source. Learn how to connect your TradingView Alerts to your Broker

2️⃣ Those rules fire alerts to your webhook endpoint.

3️⃣ Cirrus maps those alerts visually to your broker accounts and executes them under your RMS rules.

So, instead of building bots from scratch, you configure logic through the UI.

Advantages of No-Code Algo Trading

With a good platform, algo trading without coding is really “process trading”: your judgment defines the rules, the system enforces them.

Define the MTM threshold and execute it immediately with Cirrus. Let's do that with RMS Risk Locks!

When to Automate — and When Not To

Automation doesn’t mean full surrender of control. Some setups perform best when partially automated.

Automate These:

✅ Entry/exit rules based on indicators (MA crossovers, breakout, RSI conditions). ✅ Stop-loss and take-profit trailing logic.

✅ Portfolio-level position sizing and account allocation.

✅ Multi-account order replication.

Keep This Manual:

⚠️ Discretionary trades based on market news or sentiment.

⚠️ Unverified strategies or untested systems.

⚠️ Orders during illiquid times or low-volume scripts.

The goal is a hybrid discipline, automate where repetition matters, and stay hands-on where judgment adds value.

Rule Templates You Can Try

Here are a few practical examples of no-code algo trading setups often used by retail traders.

1️⃣ Breakout System (Intraday)

Condition: Price crosses the previous day’s high with volume confirmation. Trigger: TradingView alert sends “BUY {{ticker}} {{close}}”. Automation: Cirrus routes orders instantly to all connected accounts with split ratios applied.

2️⃣ Trailing Stop-Loss & Take-Profit

Condition: Once in position, trail stop-loss by 0.5% and lock profits after 1%. Trigger: TradingView alert or custom webhook updates trigger partial exits. Automation: Cirrus adjusts quantities dynamically under your defined MTM rules.

3️⃣ Multi-Account Option Strategy

Condition: Short Straddle or Iron Condor alert fires. Trigger: Webhook carries strike, expiry, and position data. Automation: Cirrus executes each leg across accounts and ensures RMS checks before each order.

Each template uses the same structure: alert → webhook → mapped execution. All configured visually — no scripts, no APIs to debug.

Where Cirrus Fits

Cirrus simplifies no-code algo trading by bridging TradingView (or any alert source) to your broker — without requiring code or custom servers.

- Visual Mapping: Assign symbol, side, qty, and price fields directly from the UI.

- Risk-First Automation: RMS and MTM locks run before every execution.

- Dry-Test Mode: Run your full flow in simulation before placing live trades.

- Multi-Broker Support: Execute across 50+ brokers simultaneously.

It’s an algo execution platform designed for traders who understand logic - not programming.

You focus on ideas. Cirrus focuses on execution.

Choosing the Best No-Code Trading Tools in India

When comparing platforms for algo trading without coding, here’s what to check:

Platforms like Cirrus prioritize these fundamentals so automation strengthens your discipline, not undermines it.

Troubleshooting Common Issues

Every execution inside Cirrus is logged, with payload and broker response stored - so you can trace exactly what happened and why.

Practical Workflow Example

Here’s what a low-code algo trading workflow looks like in action:

1️⃣ You set up TradingView alerts for your breakout strategy.

2️⃣ Alerts POST to Cirrus via your webhook endpoint.

3️⃣ Cirrus maps fields (symbol, price, qty) and runs MTM/RMS checks.

4️⃣ If all clear → instant broker execution (or dry-run if in test mode).

5️⃣ Logs appear inside the Cirrus Dashboard with timestamps and fill statuses.

That’s it — automation you can trust and verify.

Learn about Smart Multipliers on Cirrus.Trade

Frequently Asked Questions

Q1. Is no-code algo trading suitable for beginners? Yes. If you understand trading rules and use TradingView alerts, you can automate execution safely without coding.

Q2. Do I still control when trades happen? Absolutely. You decide which alerts go live and which remain manual. Cirrus only executes the conditions you define.

Q3. Is no-code automation risky? Only if unmanaged. Cirrus includes MTM and RMS locks, timestamped logs, and dry-run mode to prevent unintentional trades.

Q4. What’s the difference between low-code and no-code automation? Low-code may allow optional custom scripts. No-code algo trading (like Cirrus) uses a fully visual interface.

Conclusion

The real power of no-code algo trading is not just automation - it’s freedom from repetition. When your rules are consistent, your discipline scales.

With Cirrus, you can build and run strategies without coding, maintain full control, and ensure that every order — automated or manual — runs within your RMS guardrails.

If you’re ready to bridge your manual strategy into automation, Cirrus makes it safe, visual, and fast.

Disclaimer: This guide is for educational purposes only and does not constitute investment advice or trading recommendations. Always verify your strategy logic and broker permissions before live execution.