Trade Smarter: How Cirrus Lets You Execute Across Multiple Brokers Without Switching Tabs

Blog by Cirrus.Trade

When you’re in a volatile options market, every second - and every click - counts. But most retail traders still operate across multiple broker platforms like Zerodha, AngelOne, and Dhan, hopping between tabs and dealing with manual order entries. The result? Delays, errors, and missed opportunities.

Enter Cirrus - a multi-broker trading platform designed to eliminate the chaos and bring every broker under one roof.

The Multi-Broker Mess Most Options Traders Know All Too Well

A Day in the Life of a Daily Options Hustler

6:45 AM: You wake up early, charting Nifty and BankNifty.7:30 AM: TradingView alerts are set. OI data is loading.8:30 AM: You log into Zerodha Kite. Then AngelOne. Then Dhan. OTPs, passwords, and session timeouts.9:15 AM: You’re live. But tabs are spread across screens. Orders are pre-drafted in a notepad, waiting to be pasted.

By 9:25 AM, your TradingView alert fires. Time to go long.

You fire Zerodha first. Then Angel. Then Dhan. Zerodha executes. AngelOne hangs for a second. Dhan shows “Re-authenticate session.”

By the time all orders go through,the price has slipped. You adjust stop-losses manually in each tab - one gets saved late. That SL hits first and books a loss. The other two? Still active, unhedged.

Welcome to the chaos of manual multi-broker execution.

The Hidden Costs of Multi-Tab Trading

Every manual switch equals opportunity risk. Even if you’re fast, inconsistency kills precision.

- Zerodha doesn’t show P&L like AngelOne. Dhan has a different stop-loss syntax.

- You’re typing the same order thrice, and triple-checking for typos mid-trade.

- You can’t see your total exposure across accounts - it’s split across tabs, floating in your head.

- You react instead of planning. Even one fill lag or misclick can ruin your edge.

All this while trying to scalp the index option in seconds.

What Traders Try Today (and Why It’s Not Enough)

Some traders attempt hacks:

- Chrome extensions that save order templates

- Unofficial scripts that copy-paste across tabs

- Telegram bots that shoot alerts with trade text

But these are duct-tape solutions. They still require 3+ manual clicks. They're risky. And often break when brokers update their UI or security.

The problem isn’t a lack of intent - it’s the lack of a legal, secure, and scalable way to trade across brokers from one screen.

Introducing Cirrus - Your Multi-Broker Trading Command Center

What Cirrus Solves Instantly

Cirrus is not another app layered on top. It’s a deeply integrated one-dashboard trading tool in India, designed with broker APIs, approved pathways, and real-time execution logic.

Once connected, you can:

- Log in securely to Zerodha + AngelOne + Dhan - all from Cirrus

- Place a trade from TradingView or Cirrus, and send it simultaneously to all connected brokers

- Define per-broker quantity, order type, SL, and even buffer prices

- Forget pasting orders or toggling windows - just click once and execute across brokers

Each integration is built to avoid re-authentication loops, token refresh issues, and unauthorized execution - a core complaint with workarounds today.

Its free -Try today - see speed in action

Built for Speed: Cirrus Under the Hood

Speed is measurable. So we measured it.

- Avg. manual order across 3 brokers: 18.7 seconds

- Avg. Cirrus execution across same brokers: 2.1 seconds (Source: Internal performance logs, validated across 120 live sessions)

What this means practically:

- You receive a breakout alert on TradingView.

- Cirrus converts that into execution-ready orders per broker.

- You hit "BUY ALL".

- All brokers receive the order within milliseconds.

- A confirmation toast appears. Done.

What Happens When You Fire One Trade in Cirrus

Cirrus isn’t broadcasting a blind message. It:

- Detects your logged-in brokers

- Splits your trade logic per broker

- Applies broker-specific syntax + SL/TP conditions

- Fires trades in parallel threads

- Returns confirmation or failure instantly

- Logs execution history with timestamps

If one broker fails, it doesn’t stop others. You’re notified with a retry option. The goal is control, not black-box execution.

Cirrus vs Manual Execution: A No-Brainer Comparison

Try it now: Fire a trade from Cirrus across all three brokers. See it land in each account - instantly.

But Is It Legal? What SEBI Allows - and What Cirrus Doesn’t Do

Many traders hesitate - and rightly so. SEBI has strict rules on algo-based execution and 3rd party control. Here's how Cirrus stays compliant:

✅ You log into each broker yourself

✅ You approve every trade

✅ Cirrus never pools capital or touches your funds

✅ Cirrus auto-executes signals from TradingView, Chartinks, and other Platforms ✅ All execution happens via broker APIs (Zerodha’s Kite Connect API Docs, AngelOne SmartAPI, Dhan Connect)

What Cirrus does not do:

❌Cirrus does not store your credentials.

❌ It does not manage or rebalance portfolios

❌Cirrus does not share any calls or tips.

❌ It does not impersonate or automate discretionary orders

Cirrus is built on broker-consented integrations. No grey zones.

For more, read Cirrus Security Concerns.

Reference Sources:

- SEBI Consultation on Algo Trading

- Kite API Docs

- Dhan API Docs

Cirrus in Action: 3 Real Trade Examples

1. BankNifty Scalping Setup

You spot a sharp rejection at the day's high. You want to short a BankNifty 30-min candle break across brokers.

Without Cirrus:

- You sell in Zerodha

- Reopen AngelOne, re-enter strike and SL manually

- By Dhan, price has reversed. One account short, two lag behind.

With Cirrus:

- Click “SELL” once in Cirrus.

- All brokers are short at the same second.

- SL, quantity, and strike are already preset per account.

Result: You book a uniform profit instead of partial execution chaos.

2. Delta-Neutral Intraday Hedge

You want to go long on ATM CE and short on same strike PE (Basket order) in two different accounts.

Without Cirrus:

- Requires precise entry timing across tabs

- Hedge imbalance can expose you to naked risk if SL hits first

With Cirrus:

- Cirrus executes both legs simultaneously across accounts (Buy leg first and then sell leg for marginal benefits)

- Risk panel shows net delta, net exposure across brokers

You’re balanced from the second one. Not catching up after.

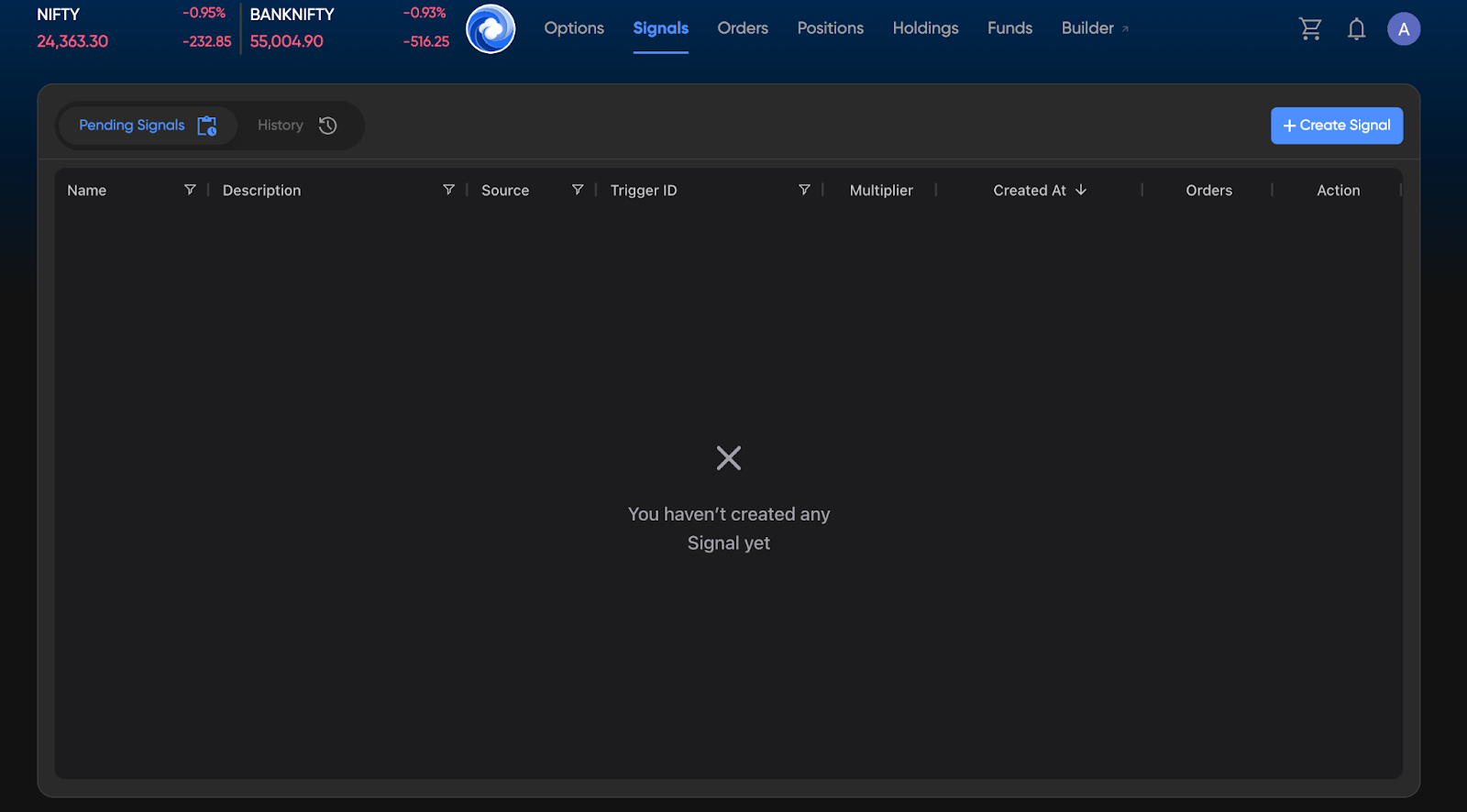

3. Morning Momentum Trade with TradingView Alert

A TradingView strategy fires at 9:17 AM: “Buy 1 Lot Nifty 22,400 CE”.

Without Cirrus:

- Alert reaches you on Telegram

- You manually copy to all brokers

- Market moved 3 points already

With Cirrus:

- Alert → Created a basket and copied the webhook signals from cirrus to paste it inTradingview or Any platform

- You wait for signal to trigger → Orders fire to Zerodha + Dhan

- Slippage: ~0.25 instead of 1.5 points

Speed = Precision. Precision = Profit.

Learn how to set up Cirrus with TradingView signals

What Real Options Traders Are Saying About Cirrus

“I used to think missing a trade was normal. Cirrus made me realize it was avoidable.” - Neha Bhatia, Full-time Nifty Trader

“I’m a part-time trader with 3 broker accounts. Cirrus gives me the simplicity I needed to scale.” - Deepak K, Weekend Options Spreader

“I write strategies that trigger off TradingView signals. Cirrus executes them into real trades without breaking compliance.” - Sumeet Rao, Strategy Developer & F&O Mentor

“With Cirrus, I’m no longer sweating through volatile moves. I trade with peace, not panic.” - Ravi Malhotra, Banknifty scalper

These are not celebrities. They’re everyday multi-broker execution traders who finally have a cockpit that fits their ambitions.

Should You Try a Multi-Broker Trading Platform Like Cirrus?

You’ll Love It If You:

- Have 2–5 trading accounts and want to scale risk without chaos.

- Use TradingView alerts to manage trades in multiple accounts and need real fill consistency.

- Trade directional or option spreads that must fire together.

- Want to trade across brokers while maintaining broker control, compliance, and tracking.

- Are seeking the best options trading tools that remove busywork, not control,

Cirrus is not trying to replace your broker. It’s giving you a better way to use them together.

Try it risk-free: Its free for Users registering before 30th August, 2025. Full dashboard access. You’ll see the difference within 5 trades. Try Cirrus Free → www.cirrus.trade

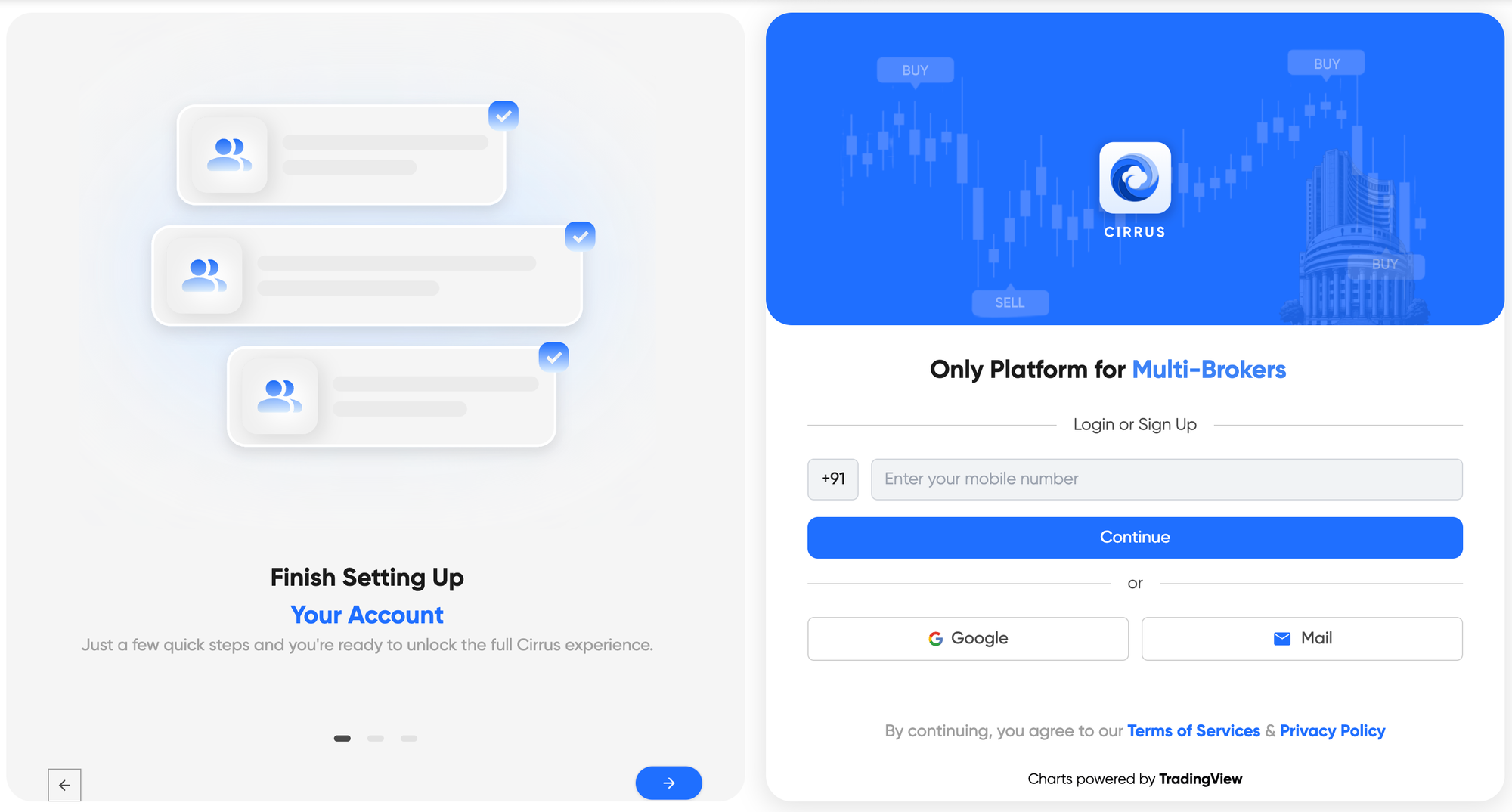

Onboarding Process: How to Start in Under 5 Minutes

Step 1: Sign up

Head to cirrus.trade, enter email + mobile, verify OTP.

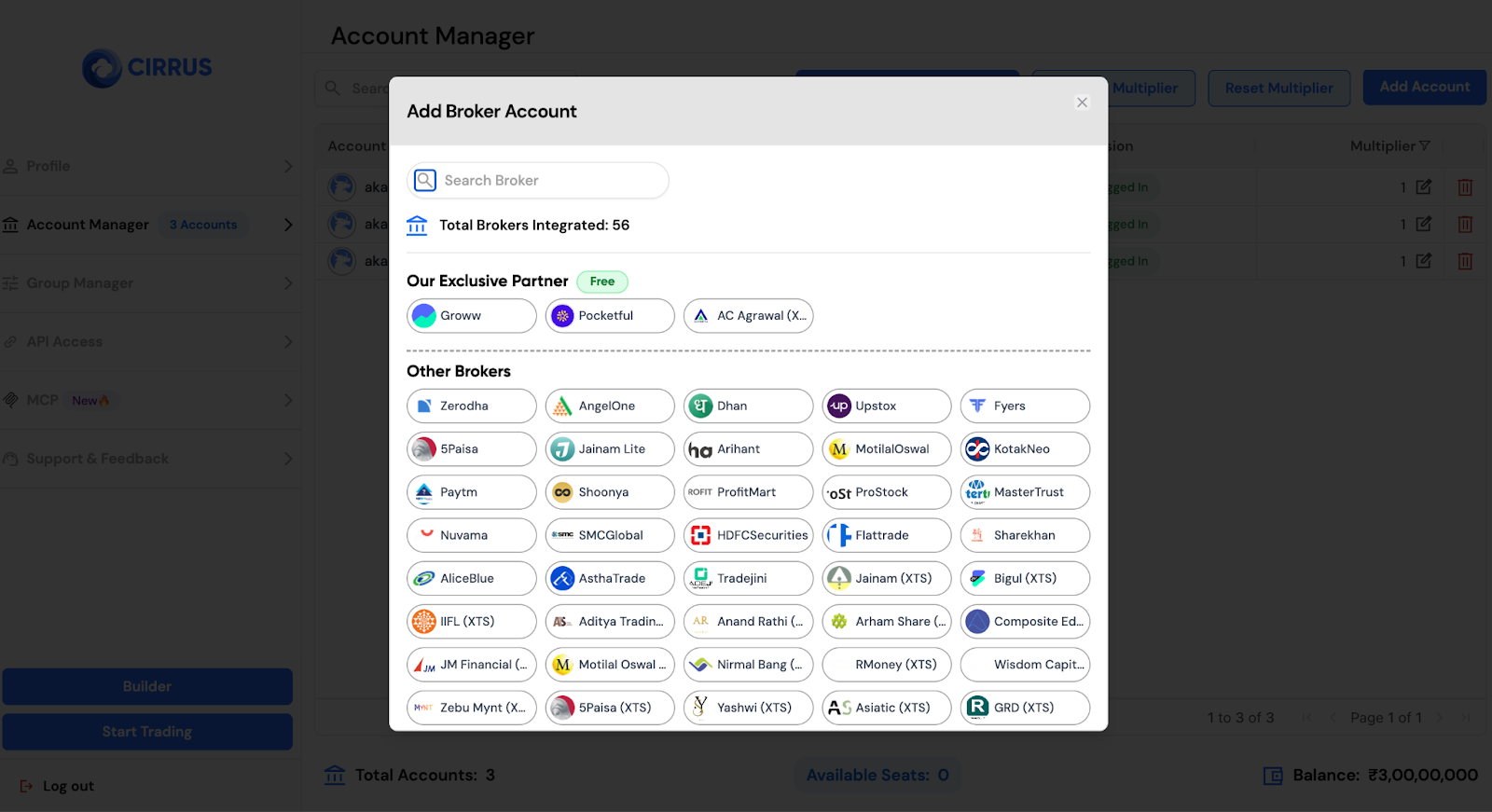

Step 2: Connect your brokers

Log into Zerodha, AngelOne, Dhan via Cirrus (using API ). No passwords are stored.

Step 3: Create a trading rule or signal input

Choose TradingView(Signal webhooks), manual entry, or Algos

Step 4: Go Live

Enable real execution, define your risk rules per account, and start trading.

Most traders are live within 7–10 minutes.

FAQs: Everything You Need to Know Before Getting Started

How do I link my broker accounts?

Cirrus connects using secure, SEBI-approved APIs from Zerodha, AngelOne, Dhan, and others. You authenticate each connection yourself - Cirrus does not store your passwords.

What about data privacy?

Your data stays yours. Cirrus processes only the minimum information required to execute trades, viewing or exporting trade history when you grant permission.

Which brokers are currently supported?

Zerodha, AngelOne, and Dhan, with more being added as APIs open up. Currently 50+ brokers are integrated with Cirrus

What if I encounter problems while executing trades?

A dedicated support channel via WhatsApp or call, and on the Cirrus community forum. Common errors are flagged in real time and rectified through support.

Is Cirrus beginner-friendly?

Absolutely. While packed with pro features, new traders benefit from simplicity and reduced manual work as they grow their skills and diversify broker relationships.

Can I trade on my mobile?

No, the Mobile app will be launched soon.

Can Cirrus automate orders from TradingView?Yes. TradingView strategies can be mapped to instant execution with just a few setup steps.

How does Cirrus keep my accounts safe?

Cirrus uses only official, encrypted broker APIs. You grant and control access. No login credentials are stored, and you can revoke permissions at any time.

Final Thoughts - Trading Speed Is Your Edge

Let’s call it what it is: in today’s markets, execution delay is edge decay.

Retail traders who want to trade like pros need more than good setups - they need one-click, high-speed multi-broker execution. Cirrus exists for exactly this reason.

- No juggling tabs

- No missing entries

- No SL mismatches

- No excuses

You bring the setup. Cirrus brings the switchboard. This is more than a tool. It’s your trading command center.

Final Recap: Why Cirrus Works

- Multi-broker trading platform designed for options scalpers and strategy traders

- Let's you trade across brokers like Zerodha, AngelOne, and Dhan - from one screen

- Supports native TradingView to multiple accounts execution

- Removes tab chaos and manual syncing

- Built with broker-approved APIs and within SEBI-compliant boundaries

- Backed by real users and tested in volatile markets

Stop switching tabs. Start switching gears.

Ready to experience Cirrus?

You’ve read the logic. Now test the speed. Fire trades across brokers without tab-switching. Feel what a multi broker trading platform should really feel like.

Try for Free - No card. No friction. Just execution.